ICFP FAQ

Loading...

Offices conveniently located in Lombard and Naperville, Illinois.

| Office: | 630-796-6161 |

| Facsimile: | 630-796-6162 |

| Lombard: | 555 E Butterfield Rd., Suite 212 Lombard, IL, 60148 |

| Naperville: By appointment only | 1700 Park St., Suite 203 Naperville, IL 60563 |

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC to residents of AK, AZ, CA, CO, DC, FL, GA, HI, KS, IA, IL, IN, LA, MA, MI, MN, MO, NC, NJ, NM, NV, NY, OK, OR, SC, SD, TN, TX, VA, WA, WI. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Independence Capital Financial Partners, LLC are not affiliated. Cambridge does not offer tax or legal advice.

© Copyright 2025 Independence Capital Financial Partners, LLC

Loading...

Now that you have built a legacy, it’s important to think about how to distribute that legacy to the next generation. Thinking ahead can make the difference when it comes to passing down not just assets, but values, to later generations and causes.

Building financial health is not only about acquiring wealth, it’s also about protecting wealth.

Things to think about:

“Good habits, which bring our lower passions and appetites under automatic control, leave our natures free to explore the larger experiences of life. Too many of us divide and dissipate our energies in debating actions which should be taken for granted.” —Ralph W. Sockman

Wealth is not just financial. It is not only found in bank vaults or investment accounts nor can it be measured in the number of homes or material items possessed. It may sound cliché but for most people it is the quality of family relationships, the human assets that really matter.

The human assets are the people in our lives. Human assets are also the values and principles that guide our lives and made us who we are today.

They are the unique stories and collective life experiences that formed across generations. Human assets include the skills our family members possess and our family’s collective interpretations of what constitutes happy and fulfilling lives. It is the governance framework used to make decisions that affect the entire family.

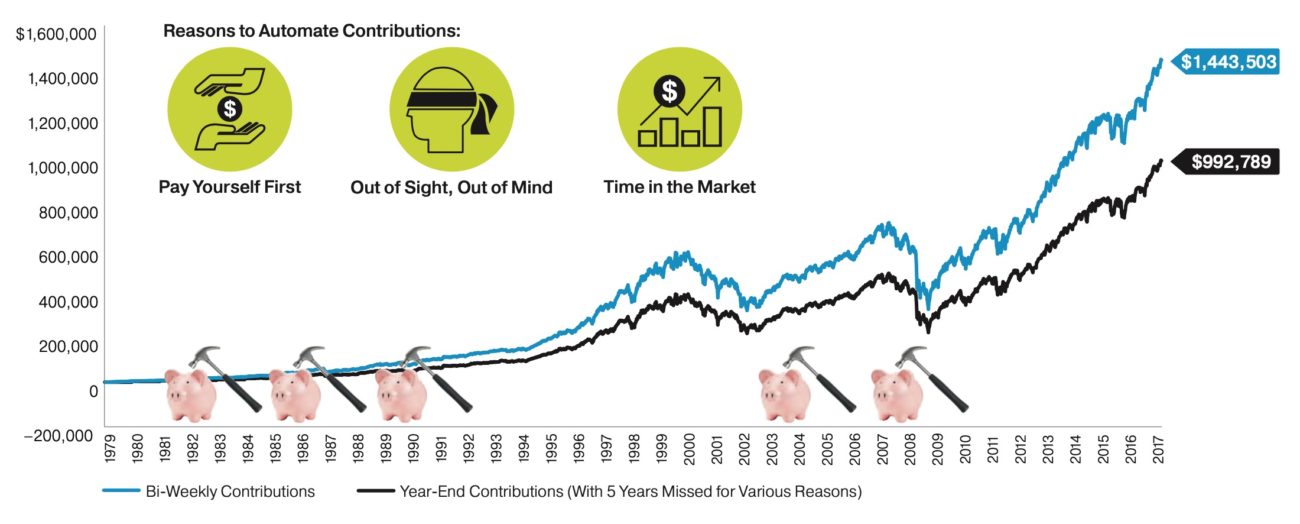

Families should set aside money for investment as early and as often as possible.

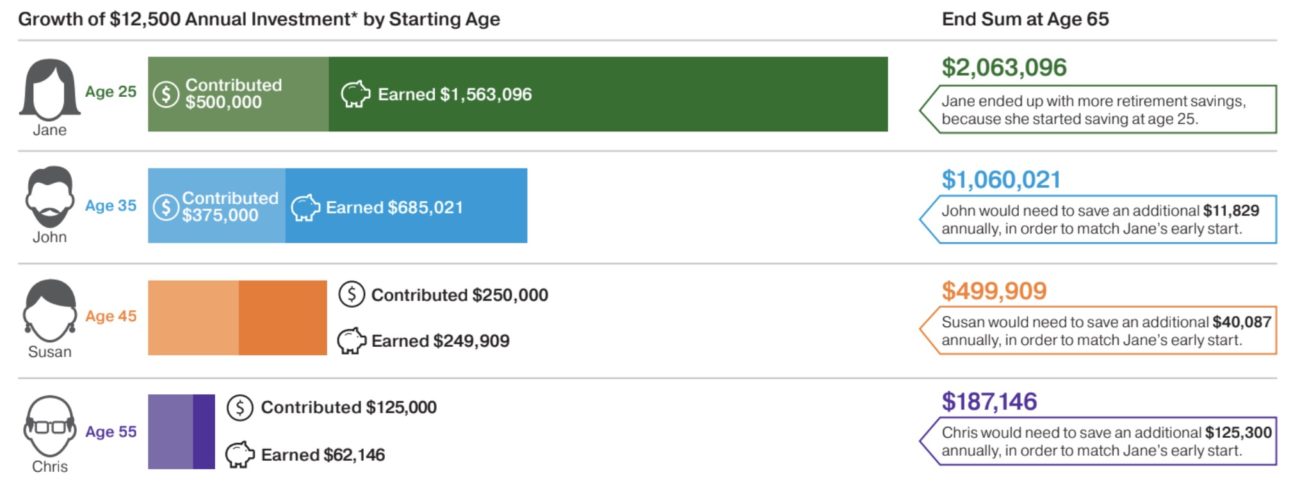

In the above example, we highlight a 25-year old who is investing $12,500 per year in hypothetical investments returning 6% per year. By age 65, our 25-year old will have contributed $500,000 into her investment account but will have earned $1,563,096 in investment returns for an end sum of $2,063,096.

But what if she started later in life? Not only will her total contributions be smaller but her earned returns will be smaller as well. In fact, if she doesn’t start until she is 45 years old then she would have to invest an additional $40,087 per year to catch up to her 25-year-old self.

In short, start young and invest often.