ICFP FAQ

Loading...

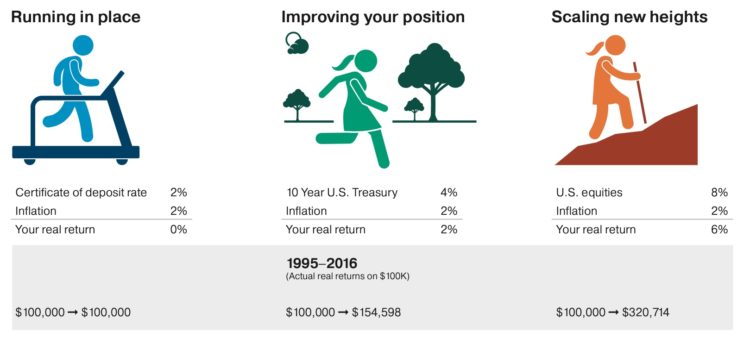

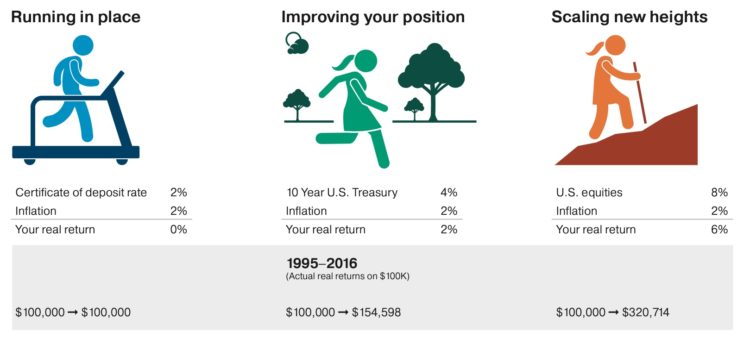

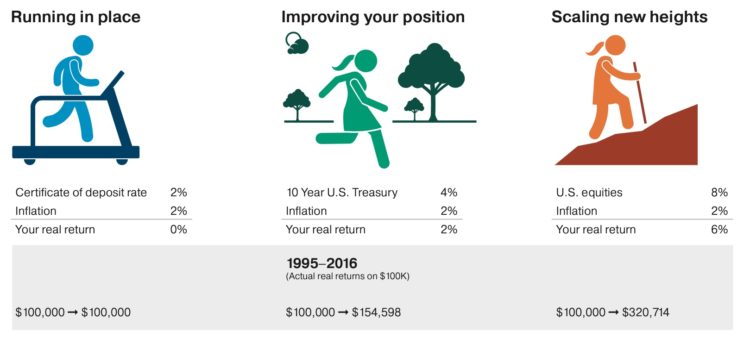

The Risk of “Safe Assets” is that you might end up running in place

How many millionaires do you know that have become wealthy by investing in savings accounts?

I rest my case.

Sources:Bankrate.com, U.S. Treasury, and Standard & Poor’s. Rates of return and inflation are derived using the averages from 1995 to 2016. U.S. equities are represented by the S&P 500 Index. Past performance does not guarantee future results.

Accounts for Individual(s)

Accounts for Employer(s)

Work with us to better understand how these types of accounts fit into your financial plan.

You should evaluate a Roth IRA at different stages of life

Income allocation is what sources of income are reflected on each year’s tax returns. These sources are different based upon your set of circumstances, but could be, but not limited to, Wages, Pensions, Social Security Benefits, Retirement Plan distributions, Taxable Savings, Dividends, Capital Gains, distributions from properties or companies; the list goes on.

Only after we have a firm understanding of your needs and goals, compensation for our services can take on one of these four forms:

Each implementation strategy has its benefits and its draw backs. The key catalyst for making a decision is based on your situation.

Others choose to create a retainer arrangement to have various financial planning services for their situation on an ongoing basis.

Diversifying advisors may provide you insight to the different levels of service other investment professionals provide. However, this perceived diversification may result in inadequate financial planning due to a lack of knowledge of holdings elsewhere, as well, as potentially unsuitable investment allocations due to the lack of knowledge of material changes to your account(s) with other institutions. The investor also may be able to save on overall investment related expenses by consolidating accounts and taking advantage of relative economies of scale.

Some engagements listed below, not limited to:

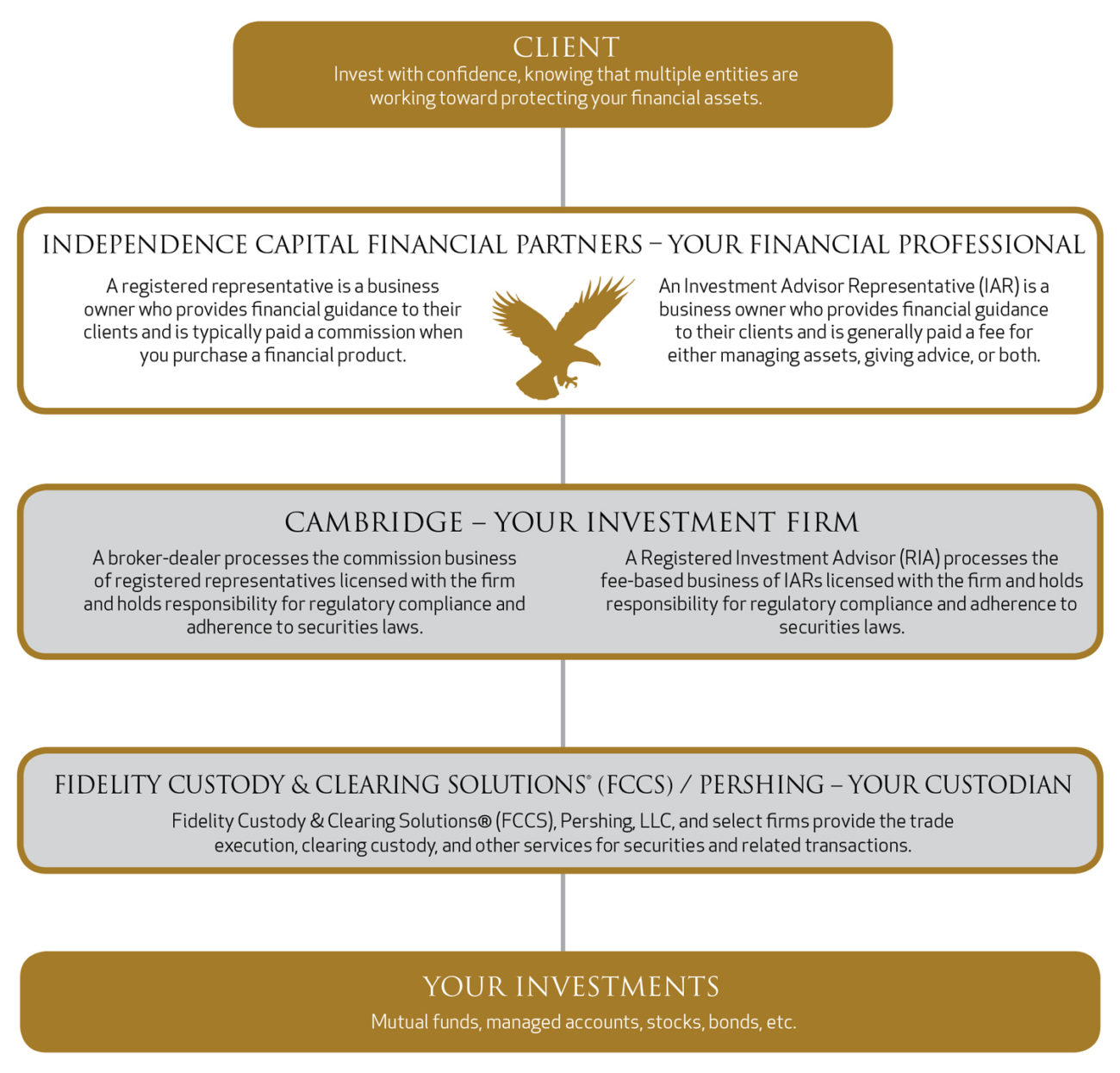

A broker/dealer is a company that a registered investment professional is required to affiliate with in order to buy or sell investment products on behalf of investors. The broker/dealer holds responsibility for regulatory compliance and adherence to securities laws. The Securities and Exchange Commission (SEC) delegates the supervision of financial advisors to the Financial Industry Regulatory Authority (FINRA).

An independent financial professional is not an employee of an investment or financial services firm – they are an independent business owner. They have the freedom to structure their business in a manner that best serves their clients. The independent financial professional utilizes the services of the broker/dealer to process investment business, provide services such as practice management and education.

You may be familiar with broker-dealers that are subsidiaries of conglomerates such as commercial banks, investment banks, and investment companies. An independent broker-dealer is different from such firms because they generally do not underwrite securities, they do not create research, and they do not engage in investment banking.

Now, more than ever, a client wants ‘‘peace of mind’’ when it comes to the safety of financial assets.

A registered representative is an independent business owner who provides financial guidance to their clients and is typically paid a commission when you purchase a financial product.

An Investment Advisor Representative (IAR) is an independent business owner who provides financial guidance to their clients and is generally paid a fee for either managing assets, giving advice or both.

A broker-dealer processes the commission business of registered representatives licensed with the firm and holds responsibility for regulatory compliance and adherence to securities laws.

A Registered Investment Adviser (RIA) processes the fee-based business of IARs licensed with the firm and holds responsibility for regulatory compliance and adherence to securities laws.

Pershing LLC, National Financial Services, LLC, and select firms provide the trade execution, clearing, custody, and other services for securities and related transactions.

Mutual funds, managed accounts, stocks, bonds, etc.

As part of our ongoing commitment to our clients, we continually seek knowledge in our industry to be best prepared to address the needs of our clients.

The Risk of “Safe Assets” is that you might end up running in place

How many millionaires do you know that have become wealthy by investing in savings accounts?

I rest my case.

Sources:Bankrate.com, U.S. Treasury, and Standard & Poor’s. Rates of return and inflation are derived using the averages from 1995 to 2016. U.S. equities are represented by the S&P 500 Index. Past performance does not guarantee future results.

Sometimes investment firms create and use identical portfolios for their clients regardless of whether the account is a taxable account or tax deferred account.

Your income allocation is comprised of the components of your taxable income you can control.

Every client wants to get the most out of their investments. They want the highest possible returns with the least amount of risk.

Improve your chances for more consistent returns over time.

Reduce overall risk.

Stay focused on your objectives

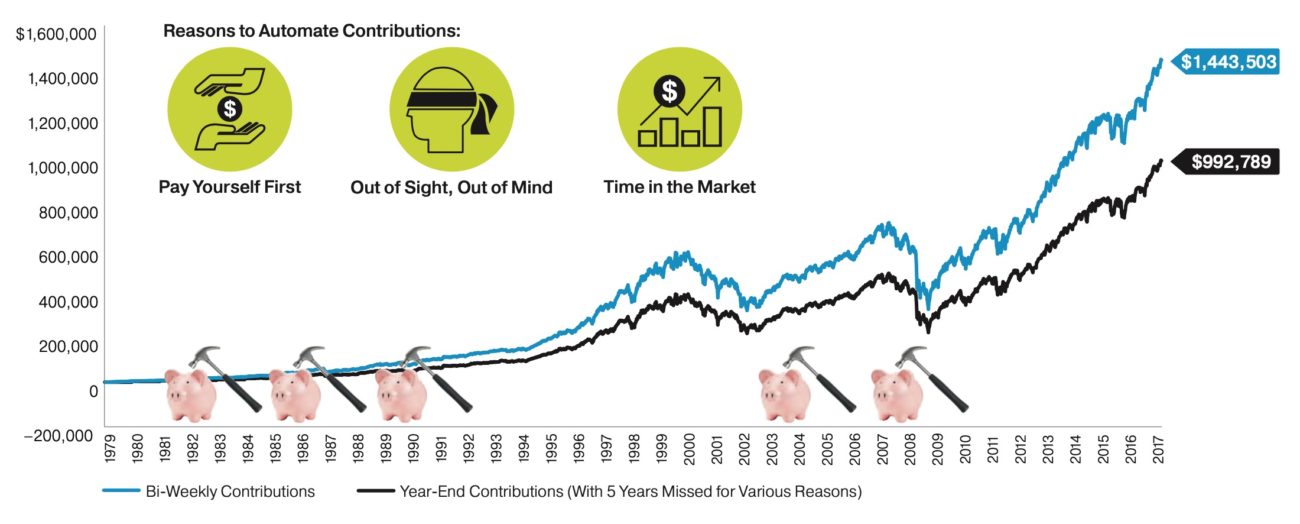

Participating in your employer’s plan helps to automate your retirement savings through a “savings habit.”

If at any time, one of these three elements are no longer present in one’s life, they likely will choose to hire and delegate to a financial advisor.

This delegation allows them to spend their time in other ways that they so choose.

“No airplane can take off without a flight plan, no ship can set sail without a plotted course.” ~ Nick Murray.

We invite you to experience a fiduciary relationship where your interests, goals, and objectives come first.

There are typically four options to consider when leaving an employer’s retirement plan, each with its benefits and considerations.

Converting a portion of your tax-deferred assets to a Roth IRA may be a planning consideration based upon your particular circumstances.

“Every night before I get my one hour of sleep, I have the same thought: ‘Well, that’s a wrap on another day of acting like I know what I’m doing.’ Most of the time I feel entirely unqualified to be a parent. I call these times being awake.”

—Jim Gaffigan

“In my house I’m the boss, my wife is just the decision maker.”

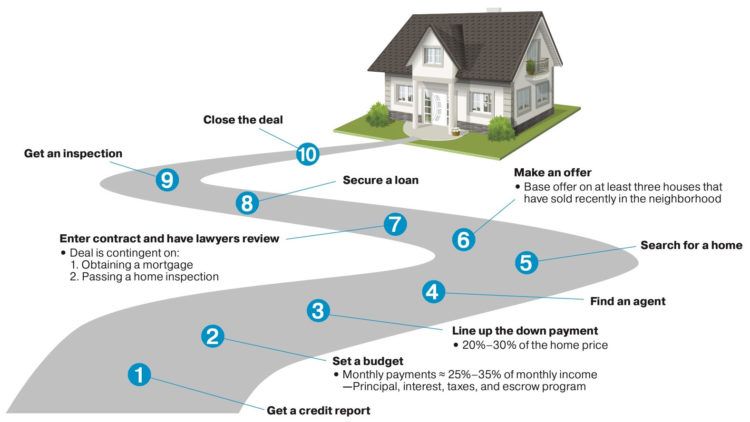

“There’s no place like home.” —Dorothy Gale

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices.

In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

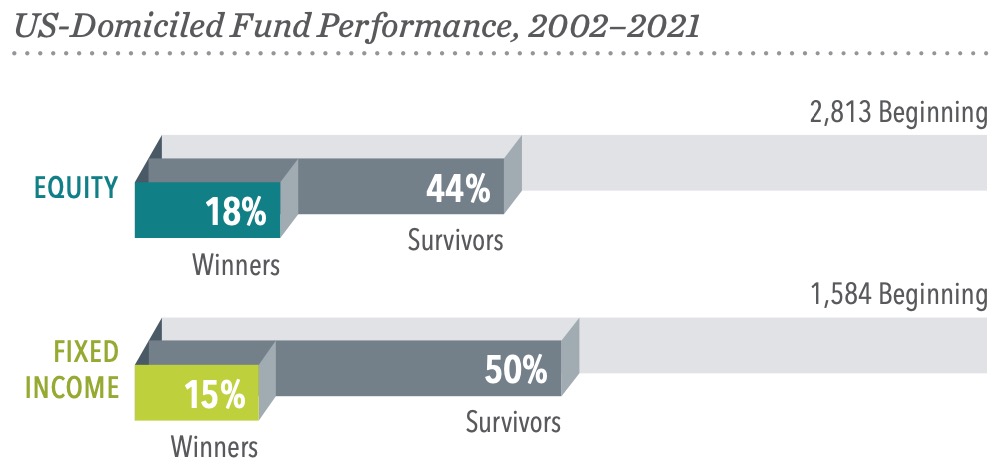

The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. As evidence, only 18% of US-domiciled equity funds and 15% of fixed-income funds have survived and outperformed their benchmarks over the past 20 years.

The sample includes funds at the beginning of the 20-year period ending December 31, 2021. Each fund is evaluated relative to its primary prospectus benchmark. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their benchmark over the period. Where the full series of primary prospectus benchmark returns is unavailable, non-Dimensional funds are instead evaluated relative to their Morningstar category index.

The sample includes US-domiciled, USD-denominated open-end and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar. Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large-Stock Blend, World Large-Stock Growth, World Large-Stock Value, and World Small/Mid Stock. Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, World Bond, and World Bond-USD Hedged. Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2022, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2022 FTSE Fixed Income LLC. All rights reserved. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US.

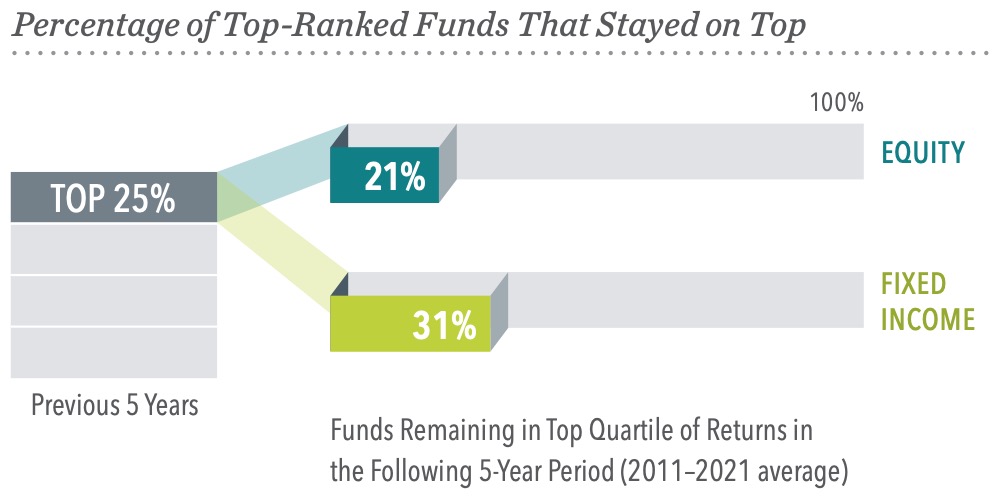

Some investors select funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most funds in the top quartile of previous five-year returns did not maintain a top-quartile ranking in the following five years.

This study evaluated fund performance over rolling periods from 2002 through 2021. Each year, funds are sorted within their category based on their previous five-year total return. Those ranked in the top quartile of returns are evaluated over the following five-year period. The chart shows the average percentage of top-ranked equity and fixed income funds that kept their top ranking in the subsequent period.

The sample includes US-domiciled, USD-denominated open-end and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar. Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large-Stock Blend, World Large-Stock Growth, World Large-Stock Value, and World Small/Mid Stock. Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, World Bond, and World Bond-USD Hedged. Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2022, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2022 FTSE Fixed Income LLC. All rights reserved. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US.

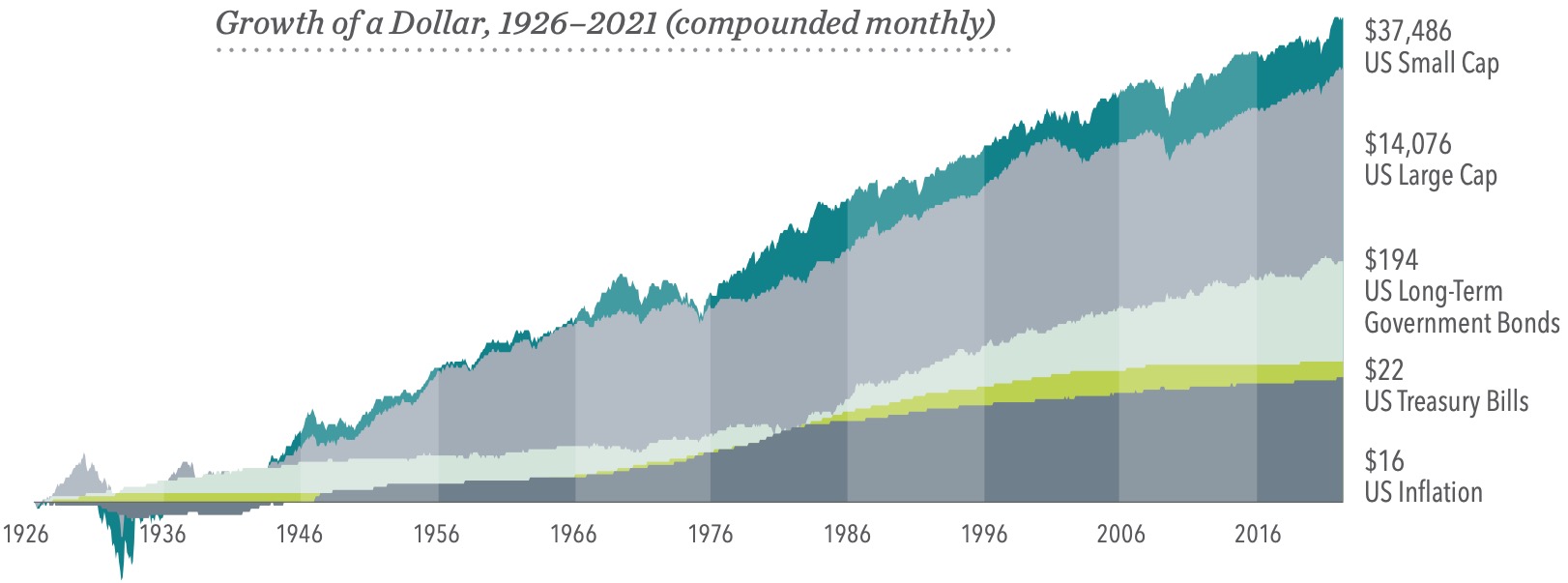

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. US Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. US Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics.

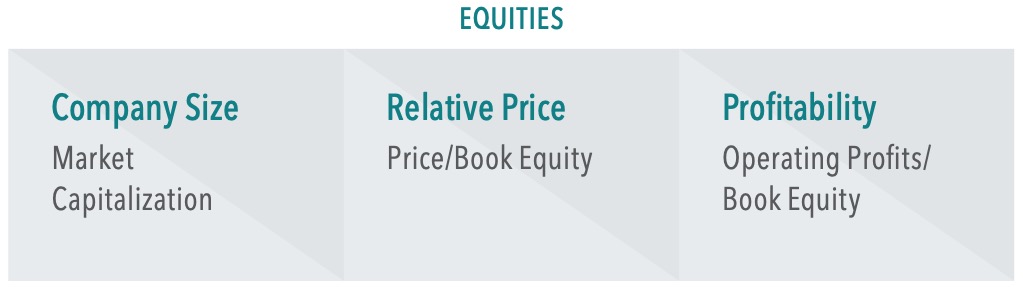

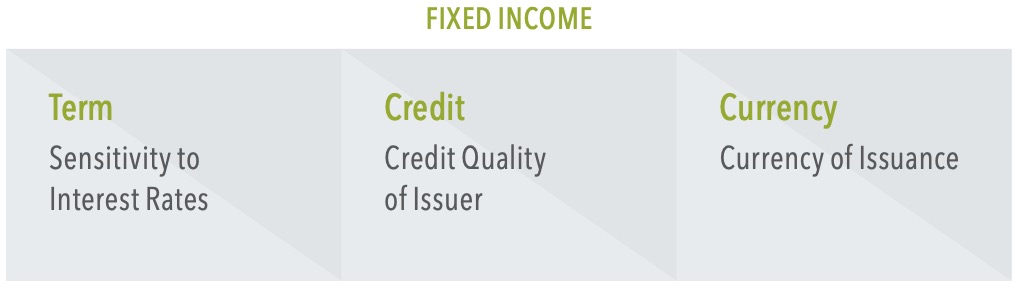

There is a wealth of academic research into what drives returns. Expected returns depend on current market prices and expected future cash flows. Investors can use this information to pursue higher expected returns in their portfolios.

Past performance is no guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book.

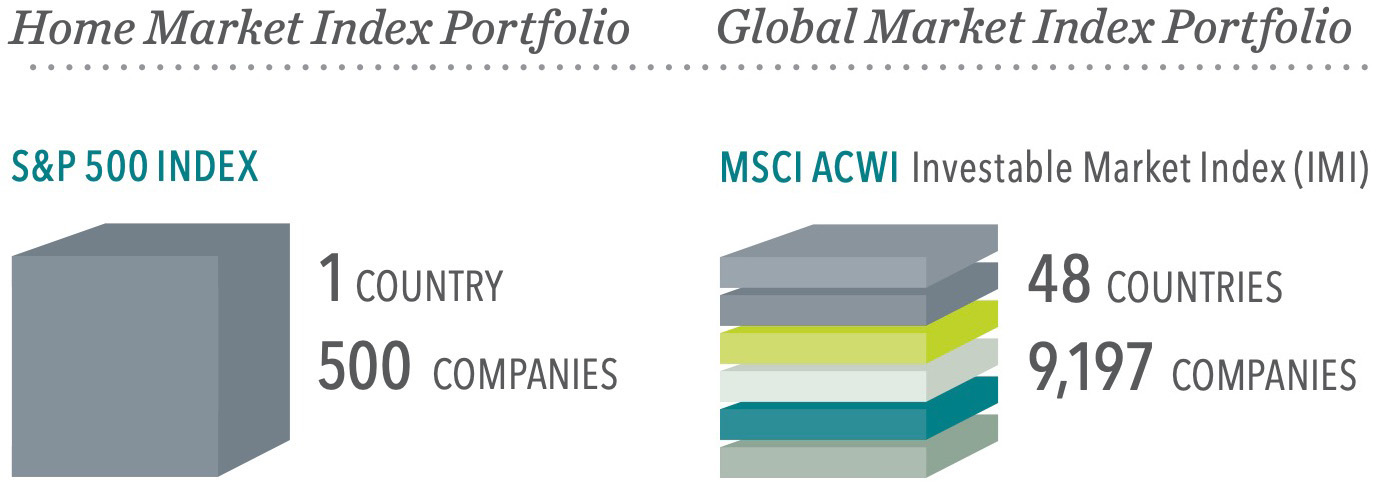

Holding securities across many market segments can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can broaden your investment universe.

Number of holdings and countries for the S&P 500 Index and MSCI ACWI (All Country World Index) Investable Market Index (IMI) as of December 31, 2021. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2022, all rights reserved. International investing involves special risks, such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks.

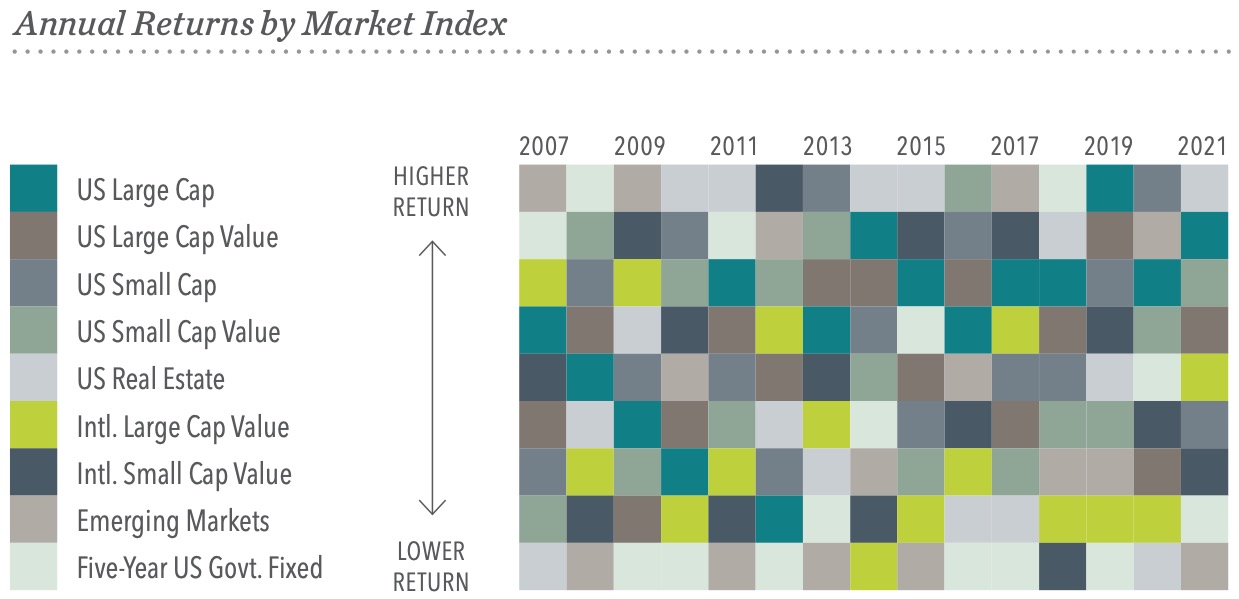

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well-positioned to seek returns wherever they occur.

In USD. US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US Government Fixed is the Bloomberg US Treasury Bond Index 1–5 Years. S&P and Dow Jones data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Bloomberg index data provided by Bloomberg. Chart is for illustrative purposes only.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Investment products are Not FDIC Insured, are Not Bank Guaranteed, and May Lose Value. Dimensional Fund Advisors does not have any bank affiliates.

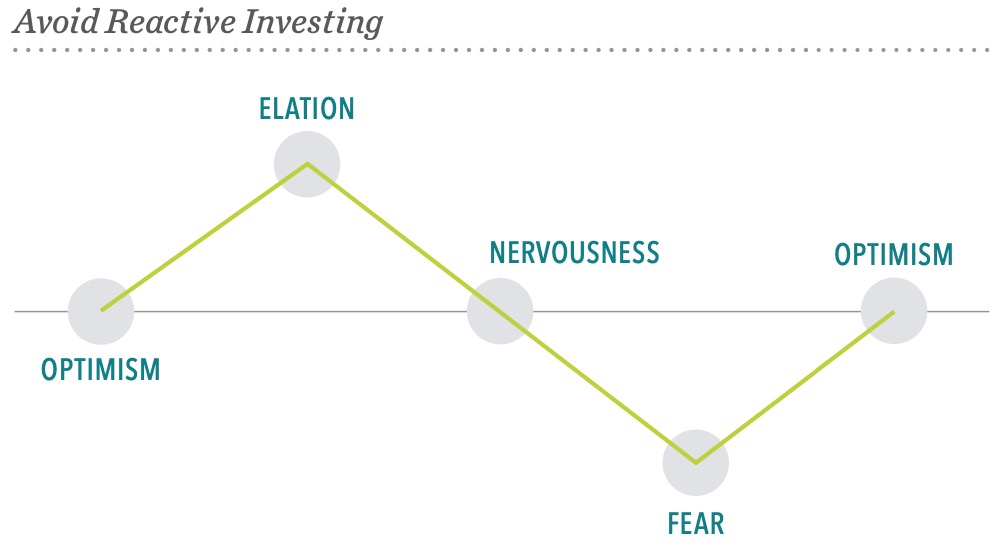

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source and maintain a long-term perspective.

A financial advisor can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. This information is for illustrative purposes only.

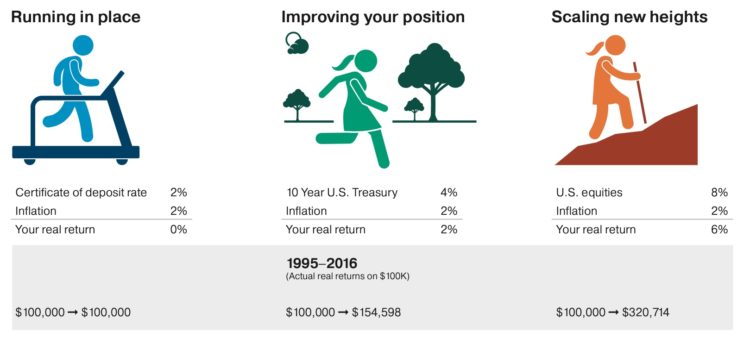

The Risk of “Safe Assets” is that you might end up running in place

How many millionaires do you know that have become wealthy by investing in savings accounts?

I rest my case.

Sources:Bankrate.com, U.S. Treasury, and Standard & Poor’s. Rates of return and inflation are derived using the averages from 1995 to 2016. U.S. equities are represented by the S&P 500 Index. Past performance does not guarantee future results.

The Risk of “Safe Assets” is that you might end up running in place

How many millionaires do you know that have become wealthy by investing in savings accounts?

I rest my case.

Sources:Bankrate.com, U.S. Treasury, and Standard & Poor’s. Rates of return and inflation are derived using the averages from 1995 to 2016. U.S. equities are represented by the S&P 500 Index. Past performance does not guarantee future results.

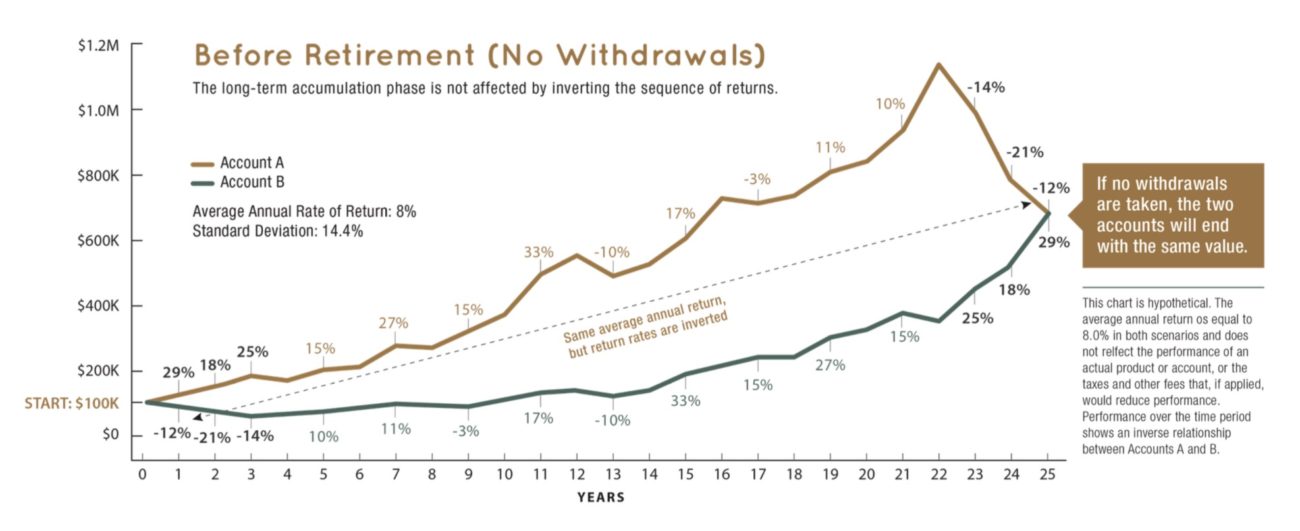

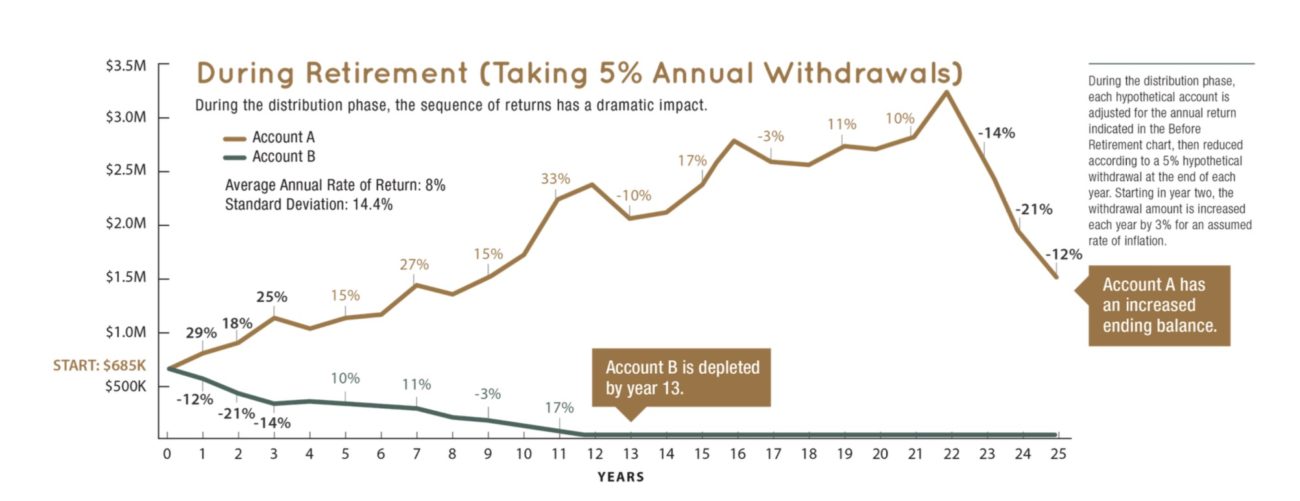

You also may need to consider your potential portfolio returns and your life expectancy.

The Risk of “Safe Assets” is that you might end up running in place

How many millionaires do you know that have become wealthy by investing in savings accounts?

I rest my case.

Sources:Bankrate.com, U.S. Treasury, and Standard & Poor’s. Rates of return and inflation are derived using the averages from 1995 to 2016. U.S. equities are represented by the S&P 500 Index. Past performance does not guarantee future results.

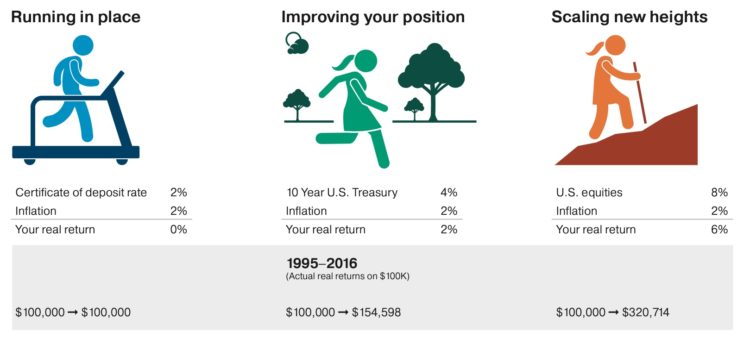

Risk profiling is a process for finding the optimal level of investment risk for your client by balancing their risk required, risk capacity and their individual risk tolerance.

Risk Required is the risk associated with the return required to achieve the client’s goals from the financial resources available.

Risk Capacity is the level of financial risk the client can afford to take.

Risk Tolerance is the level of financial risk the client is emotionally comfortable with.

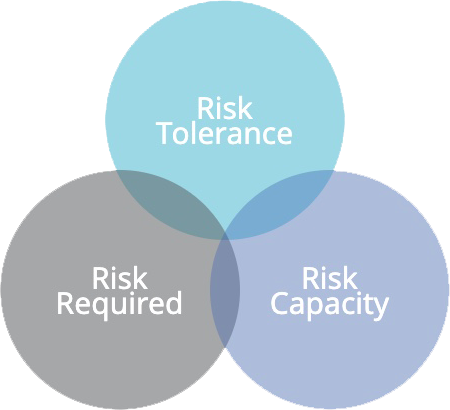

To better understand your Goals, Needs, and Vision for your desired Asset Transfer Plan.

Asset transfers plans usually need to established with the assistance of an attorney to create:

Generally, any account or insurance policy that has a beneficiary, such as, but not limited to:

It can be very difficult for investors to be objective and unemotional when it comes to their money.

For that reason, we believe one of the best ways to determine your risk tolerance is to:

It may be useful to match dependable income sources with fixed retirement expenses while coordinating other investments with more discretionary expenses.

To better understand your Goals, Needs, and Vision for your desired Power of Attorney Plan.

Sometimes investment firms create and use identical portfolios for their clients regardless of whether the account is a taxable account or tax deferred account.

Offices conveniently located in Lombard and Naperville, Illinois.

| Office: | 630-796-6161 |

| Facsimile: | 630-796-6162 |

| Lombard: | 555 E Butterfield Rd., Suite 212 Lombard, IL, 60148 |

| Naperville: By appointment only | 1700 Park St., Suite 203 Naperville, IL 60563 |

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC to residents of AK, AZ, CA, CO, DC, FL, GA, HI, KS, IA, IL, IN, LA, MA, MI, MN, MO, NC, NJ, NM, NV, NY, OK, OR, SC, SD, TN, TX, VA, WA, WI. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Independence Capital Financial Partners, LLC are not affiliated. Cambridge does not offer tax or legal advice.

© Copyright 2024 Independence Capital Financial Partners, LLC

Loading...

“Good habits, which bring our lower passions and appetites under automatic control, leave our natures free to explore the larger experiences of life. Too many of us divide and dissipate our energies in debating actions which should be taken for granted.” —Ralph W. Sockman

Things to think about:

Building financial health is not only about acquiring wealth, it’s also about protecting wealth.

Now that you have built a legacy, it’s important to think about how to distribute that legacy to the next generation. Thinking ahead can make the difference when it comes to passing down not just assets, but values, to later generations and causes.

Wealth is not just financial. It is not only found in bank vaults or investment accounts nor can it be measured in the number of homes or material items possessed. It may sound cliché but for most people it is the quality of family relationships, the human assets that really matter.

The human assets are the people in our lives. Human assets are also the values and principles that guide our lives and made us who we are today.

They are the unique stories and collective life experiences that formed across generations. Human assets include the skills our family members possess and our family’s collective interpretations of what constitutes happy and fulfilling lives. It is the governance framework used to make decisions that affect the entire family.

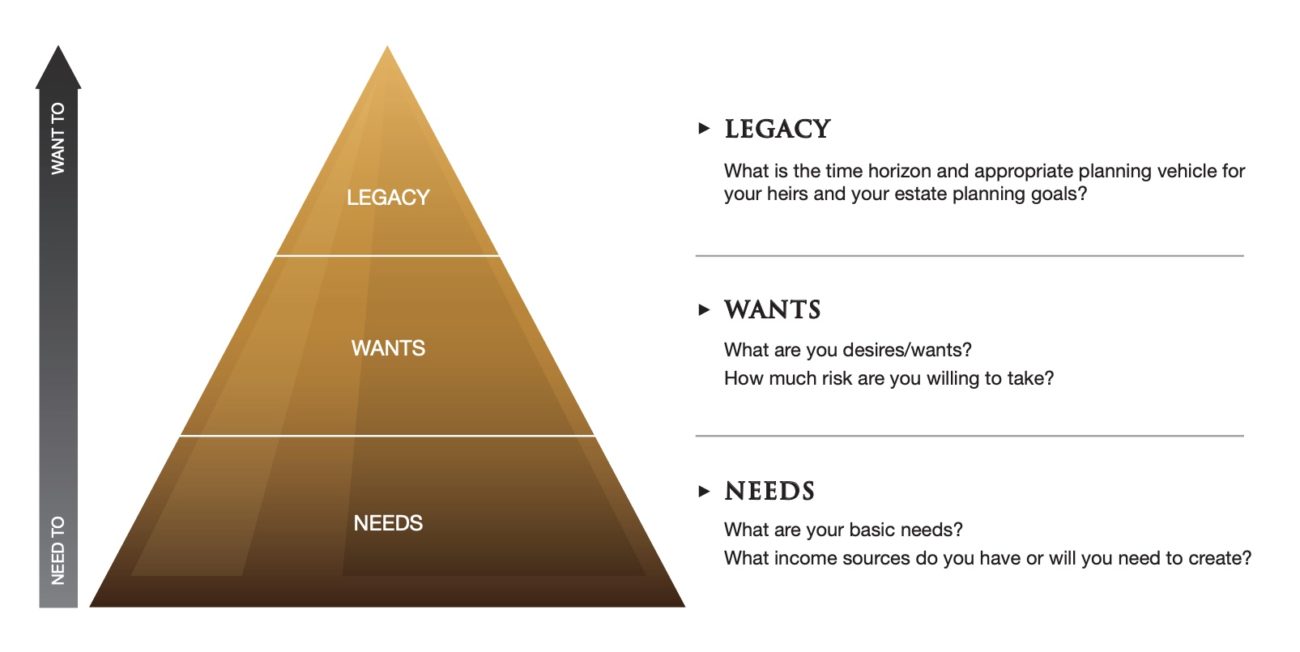

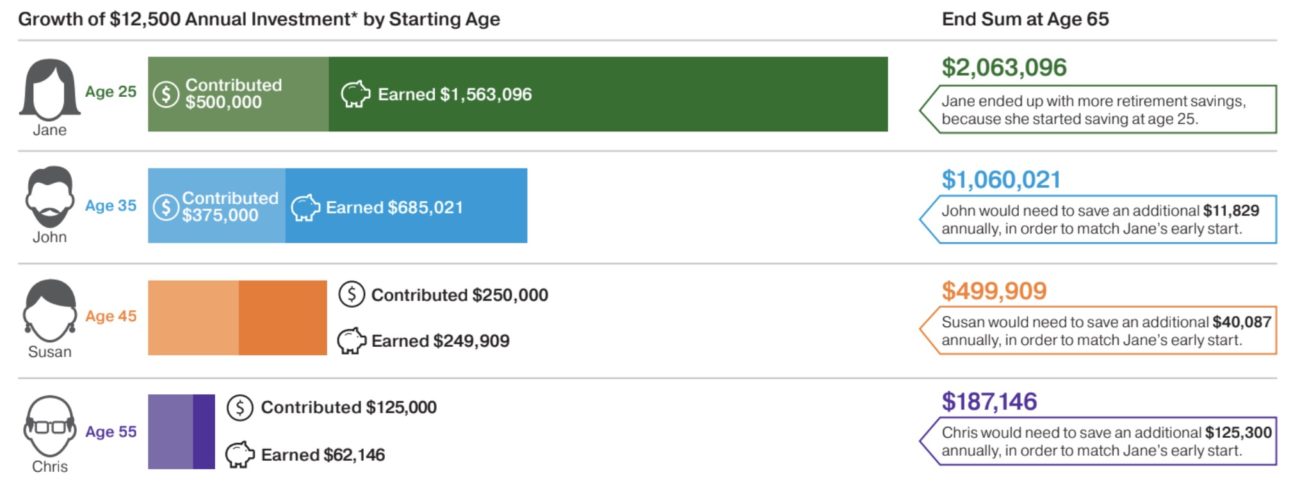

Families should set aside money for investment as early and as often as possible.

In the above example, we highlight a 25-year old who is investing $12,500 per year in hypothetical investments returning 6% per year. By age 65, our 25-year old will have contributed $500,000 into her investment account but will have earned $1,563,096 in investment returns for an end sum of $2,063,096.

But what if she started later in life? Not only will her total contributions be smaller but her earned returns will be smaller as well. In fact, if she doesn’t start until she is 45 years old then she would have to invest an additional $40,087 per year to catch up to her 25-year-old self.

In short, start young and invest often.