ICFP FAQ

Loading...

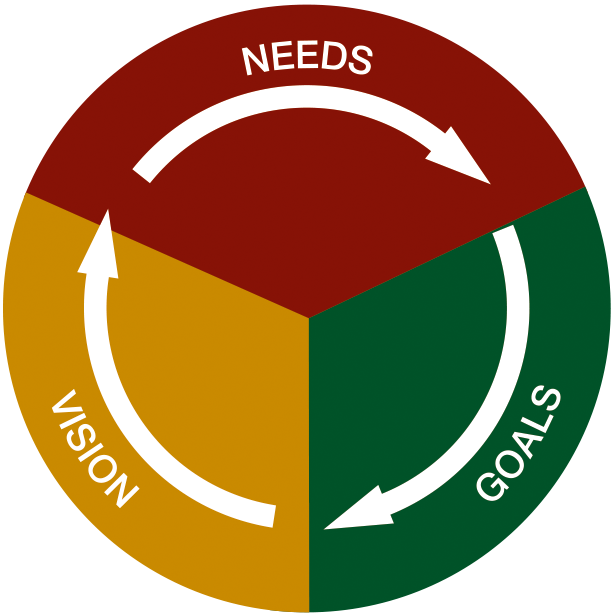

We start first with understanding your Needs, Goals and Vision for the future.

With this understanding we can help define and shape your priorities.

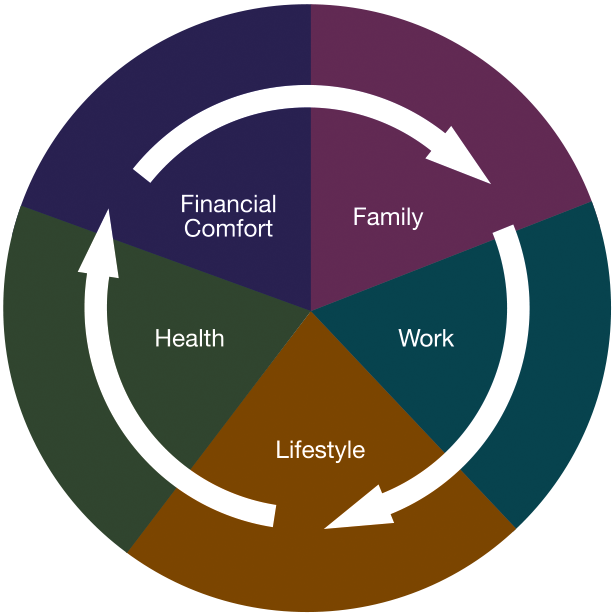

We’ve created a Financial Timeline so you can see a typical life timeline of events and financial priorities.

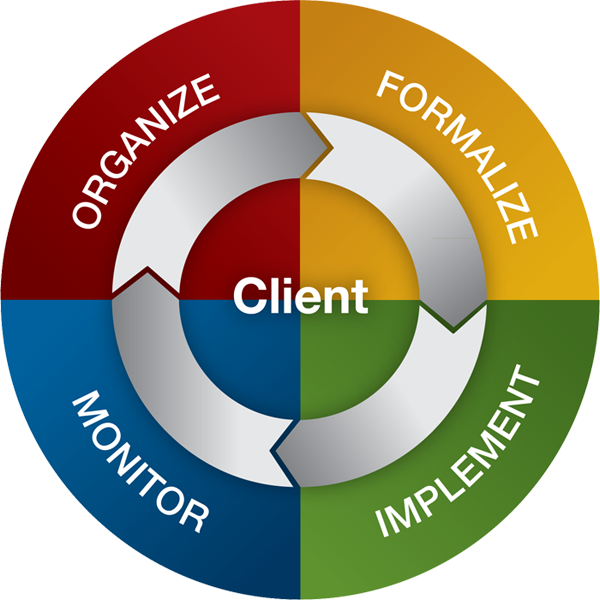

The client-centric approach at ICFP focuses on our partnership with you.

Our process is designed to provide financial direction and the confidence to proceed toward your financial goals.

Ready to learn more?

Your needs provide the foundation and direction of our relationship, even when the unplanned occurs.

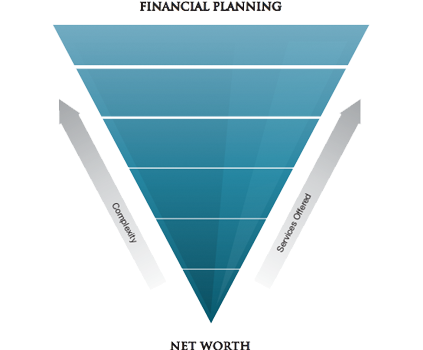

Partnering with ICFP is the perfect formula for managing this complexity.

Financial Planning provides the framework for your financial future and the goals you wish to attain. As you strive to grow your personal net worth, the financial challenges you face may become increasingly more complex. These complexities create challenges that fall outside the realm of basic portfolio design and ongoing wealth management.

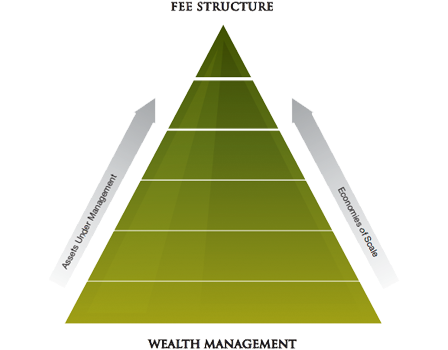

Wealth Management consists of continually identifying the investment vehicles and instruments that put you in the best position to grow your net worth. Fees are based upon your investible assets. The fees generally decrease, as a percentage of investible assets, as your net worth grows. Wealth Management services include portfolio development and management, asset allocation, and ongoing monitoring.