Getting Started

Families should set aside money for investment as early and as often as possible.

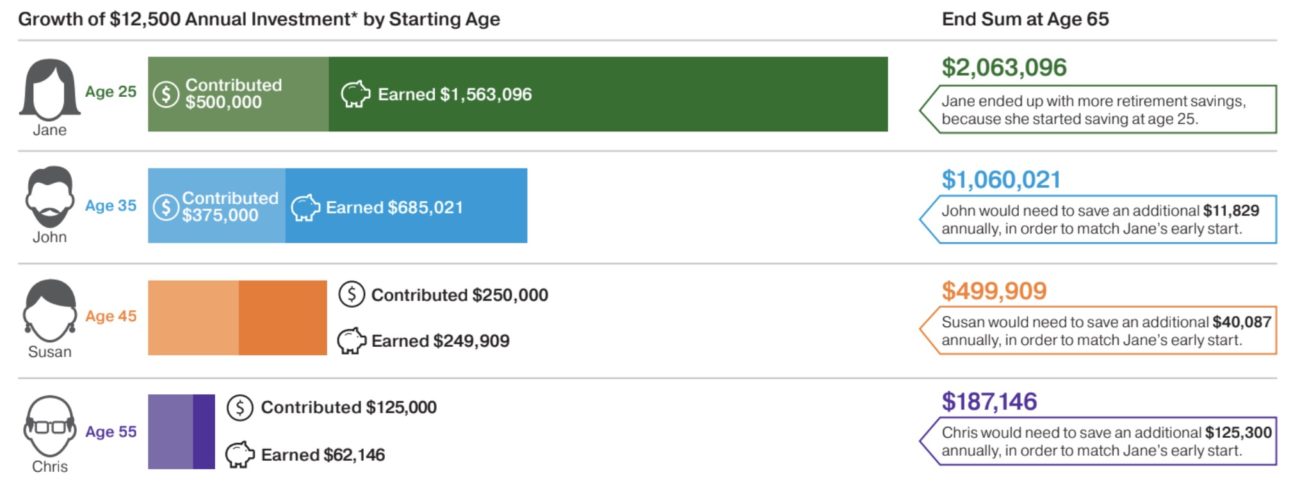

In the above example, we highlight a 25-year old who is investing $12,500 per year in hypothetical investments returning 6% per year. By age 65, our 25-year old will have contributed $500,000 into her investment account but will have earned $1,563,096 in investment returns for an end sum of $2,063,096.

But what if she started later in life? Not only will her total contributions be smaller but her earned returns will be smaller as well. In fact, if she doesn’t start until she is 45 years old then she would have to invest an additional $40,087 per year to catch up to her 25-year-old self.

In short, start young and invest often.